“Driven predominantly by strong performances from new job creation, building material production, and the value of wholesale trade sales of construction materials, activity in the construction sector enjoyed a buoyant third quarter.”

Dr Roelof Botha.

Johannesburg, 7 December 2023 – Afrimat, the JSE-listed mid-tier mining and materials company providing construction materials, industrial minerals, bulk commodities and future materials and metals, has released the findings of its Afrimat Construction Index (ACI) for the third quarter of 2023. The ACI is a composite index of the level of activity within the building and construction sectors, which is compiled by economist Dr Roelof Botha on behalf of Afrimat.

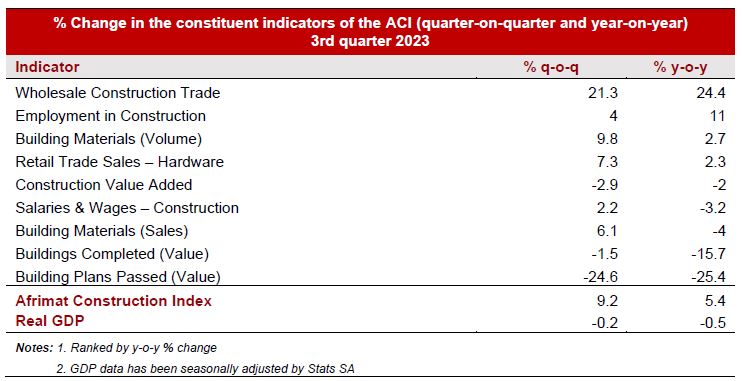

According to Dr Botha, the lethargy of the economy as a whole during the third quarter was not evident in the construction sector, with six of the nine constituent indicators of the ACI recording positive real growth rates compared to the second quarter.

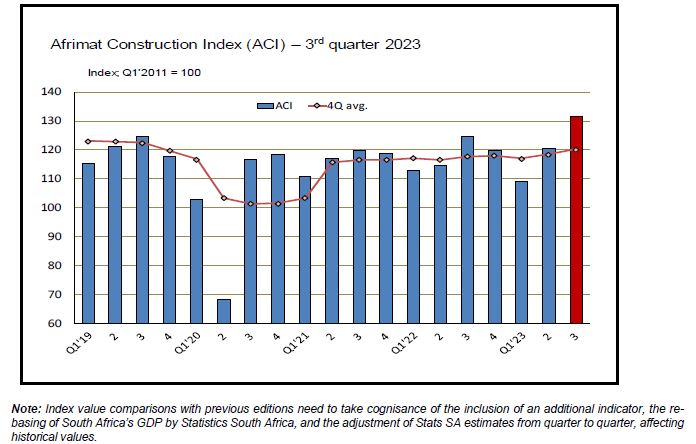

The index recorded a level of 131.5 in the third quarter, compared to 120.3 in the previous quarter. “Significantly, this is the highest level since the fourth quarter of 2016 and, if the current momentum can be maintained in the fourth quarter of 2023, it may herald a new, sustained growth phase in the construction sector,” said Botha.

He added that it was especially encouraging that the important indicator of job creation continued to record a healthy growth rate, with 145,000 new jobs having been created since the beginning of 2023. “Equally encouraging is the increase of almost 10% in the volume of building materials produced compared to the previous quarter, with year-on-year growth also having returned to positive growth.”

The quarter-on-quarter increase of 9.2% is in sharp contrast to the marginal decline in the country’s GDP and builds on the positive ACI growth rate of 5.8% recorded in the second quarter. “Also worth noting is that the year-on-year increase has moved from less than one per cent in quarter two to 5.4 in quarter three, signalling the likelihood that construction sector activity may have entered a new, sustained growth phase”.

He believes that the lethargy in the year-on-year performance of construction sector activity is, in the main, the result of the South African Reserve Bank’s hawkish monetary policy, which has resulted in the highest interest rates in 15 years. “Hopefully, interest rates will be lowered before the end of the year, which will go a long way to restoring consumer confidence and to lower the Botha further pointed out that the only two indicators in the ACI that fared poorly were the “Value Of Building Plans Passed” and “Buildings Completed at Larger Municipalities”. He explains that these data sets are aligned to a sharp decline in the number of mortgage bond applications administered by BetterBond and a hefty increase in the average deposit required for a home loan.

“The residential property market is suffering at the hands of unduly restrictive monetary policy in South Africa. With the consumer price index within the South African Reserve Bank’s target range for inflation and no sign whatsoever of demand inflation in the economy, lower interest rates are overdue and will certainly serve to boost construction activity further. ”

According to Botha, a number of key drivers of further growth in the construction sector may strengthen or emerge during 2024. They include the following:

- Progress with public/private partnerships or outright privatisation in the area of repairing, maintaining and expanding the country’s logistics infrastructure.

- Progress with the inevitable and gradual switch to renewable energy, intrinsically linked to construction activity.

- New capital formation in the economy, which recorded its seventh successive double-digit growth rate during the third quarter of 2023.

- Closer cooperation between the South African Police Service and contractors to prevent undue criminal activity at building sites, including adequate fiscal support.

- A larger measure of price stability in the economy, which may lead to lower interest rates by early 2024.

In addition to the sterling performance of wholesale sales of construction materials, new job creation, and the volume of building materials, other highlights were the positive real growth in the value of building material sales, retail hardware sales and remuneration of construction workers (quarter-on-quarter).

Botha concluded by saying that the impressive uptick in the ACI in this latest reading is especially encouraging against the background of extremely high interest rates and a generally subdued macro-economic environment. “The positive trend seems to have been influenced by the increase in the public sector’s spending on capital formation, which will hopefully continue and gather momentum over the next few years as the damage done to the country’s infrastructure by state capture is addressed ”

Afrimat’s CEO, Andries an Heerden, said that the Group’s unwavering commitment to a diversified portfolio of commodities and revenue streams has solidified its position as an industry leader. “This strategic approach, coupled with our rigorous capital allocation practices, empowers us to navigate economic and commodity fluctuations with unwavering resilience.”

The tremendous recovery in the Afrimat Construction Materials business echoes the sentiment of the findings in this edition of the ACI. “A strong performance from Construction Materials is due to successful and well thought through efficiency drives across the business, as well as an uptick in demand for aggregates and other products for roads and private buildings ”

The Group has built a diverse portfolio of mature businesses, while also investing in new projects, establishing green fields operations, and underpinning existing operations with efficiency projects. “Strategic projects such as the Jenkins iron ore mine, the Nkomati anthracite mine and Glenover are all progressing very well, and these will purposefully provide Afrimat with deeper diversification,” added an Heerden.

Afrimat is anticipating an imminent decision from the Competition Tribunal to ratify the Competition Commission approval of the exciting acquisition of Lafarge South Africa Holdings (Pty) Ltd, which will add several well-positioned and resourced aggregate quarries, high-quality fly-ash sources, ready-mix batching plants, an integrated cement plant, cement grinding plants, and cement depots to Afrimat’s arsenal of products.

Van Heerden concluded by saying that Afrimat’s strategic journey toward increasing diversification has enabled growth for stakeholders, shareholders and employees alike.

“We intend to continue this path to ensure sustainable growth and a meaningful contribution to South Africa. The country finds itself in a precarious position, which needs each South African as well as business to come together to assist wherever possible. If we all do our part, no matter how small, I see a bright future for our country.”

-Ends-

Issued for: Afrimat Limited

- Contact: Andries van Heerden, Chief Executive Officer (CEO)

- Tel: 021-917-8853

- Email: andries@afrimat.co.za

- Website: www.afrimat.co.za

- Issued by: Keyter Rech Investor Solutions

- Contact: Vanessa Rech

- Tel: 083-307-5600

- Email: vrech@kris.co.za