Johannesburg, 25 March 2025 – Afrimat, a leading mid-tier mining and materials company providing Bulk Commodities, Construction Materials, Industrial Minerals and Future Materials and Metals, has released the findings of its Afrimat Construction Index (ACI) for the fourth quarter of 2024. The ACI is a composite index of the level of activity within the building and construction sectors and is compiled by economist Dr Roelof Botha on behalf of Afrimat.

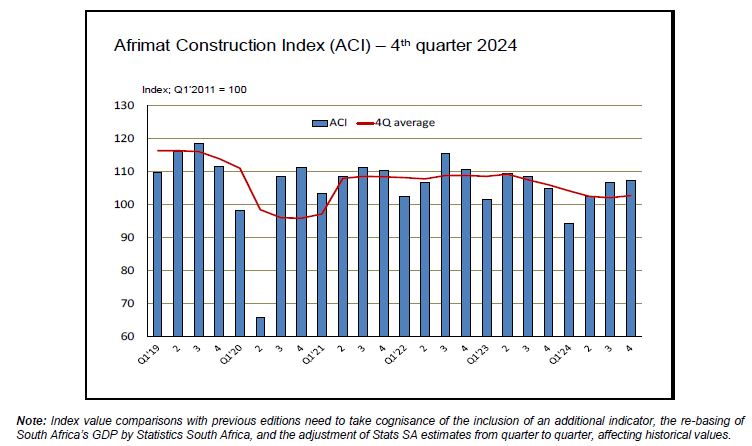

The ACI has now improved for three quarters in succession, the first time this has occurred since the pandemic-related lockdowns, re-establishing a familiar trend in the construction sector at large.

According to Dr Botha, the recent lowering of the repo rate, and, by inference, also the prime overdraft rate, has exerted a marginal positive impact on the ACI, with the year-on-year increase of 2.5% outperforming the year-on-year real GDP growth rate of 0.5% by a considerable margin.

However, he pointed out that for quarter-on-quarter growth rates, the ACI only increased by 0.5%, compared to 1.5% for the economy as a whole. “This discrepancy can be explained by withdrawals via the new two-pot retirement system, as well as the two interest rate cuts of 25 basis points each during the end of 2024, which released a measure of pent-up demand for household consumption expenditure,” Dr Botha explained, adding that household consumption expenditure represents almost 65% of GDP, whilst capital formation, which encompasses most construction activity, represents 14.5% of total GDP.

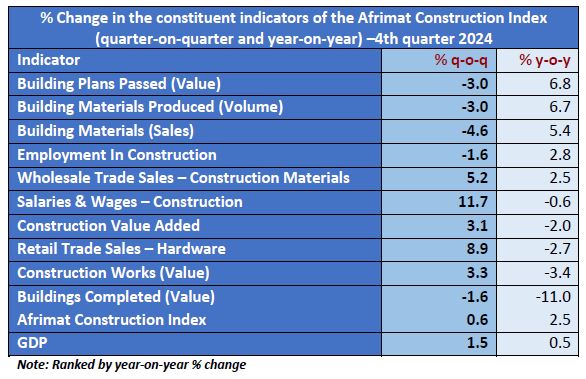

During the fourth quarter of 2024, five of the ten constituent indicators comprising the index had positive readings (year-on-year), with four of the top-five ranked indicators remaining amongst the previous quarter’s top-five performers.

“However, it is a point of concern that the real value of construction works remains in the doldrums, with a year-on-year contraction of 3.4% in the fourth quarter in real terms. The public sector’s contribution to overall capital formation in South Africa has diminished quite dramatically since the onset of state capture and, more recently, the restrictive monetary policy stance, which took interest rates to their highest level in one-and-a-half decades.”

The outstanding performers amongst the ten indicators of the ACI during the fourth quarter were (year-on-year rates of increase in parentheses):

- Value of Building Plans Passed by the metros and larger municipalities (6.8%)

- Value of Building Materials Produced (6.7%)

- Value of Building Material Sales (5.4%)

- Employment in Construction (2.8%)

- Wholesale Trade Sales of Construction Materials (2.5%)

According to Dr Botha no doubt exists over the negative effects that record high interest rates have exerted on the economy, in general, and the construction industry, in particular. This is confirmed by several key economic indicators, most notably exceptionally high debt-servicing ratios and a persistent decline in the real value of credit extension. The S&P Global Purchasing Managers’ Index (PMI) for South Africa has been below the neutral 50-mark since the beginning of the year and capital formation declined by 3.7% during 2024 – at a stage when investment in the repair and expansion of the country’s infrastructure has become a critical imperative.

On a positive note, inflation is well and truly under control, with the February reading of the CPI remaining at the bottom end of the inflation target range of 3% to 6%. Lower producer prices, combined with declines in the oil price and a resilient Rand exchange rate, should secure further interest rate cuts in the course of 2025.

Other good news is the welcome return to employment creation in the construction sector. Thanks to a splendid performance during the third quarter of 2024, total employment in construction finally managed to return to the pre-Covid level of 1.35 million, although this figure is still well short of the 1.5 million recorded in the third quarter of 2018.

According to Andries van Heerden, the upswing in the ACI bodes well for the construction sector. “ Afrimat remains poised for growth and with capacity to supply any improvement in the sector. We have bolstered our long-term growth strategy by expanding a well-chosen asset base in the mining, quarrying, cement, and related industries, with the integration of Lafarge South Africa now complete.”

He added that Afrimat, always in support of growth initiatives and job creation in South Africa, now has 3,875 employees, attributable to the Lafarge acquisition and 228 new employees hired in the past six months.

“To ether with prospects for Nkomati Anthracite, an expanded Construction Materials business through Lafarge, innovative cement products, and other growth initiatives, this has balanced Afrimat’s diversity, placing the Group on a sustainable pathway forward.”

-Ends-

Issued for: Afrimat Limited

- Contact: Andries van Heerden, Chief Executive Officer (CEO)

- Tel: 021-917-8853

- Email: andries@afrimat.co.za

- Website: www.afrimat.co.za

- Issued by: Keyter Rech Investor Solutions

- Contact: Vanessa Rech

- Tel: 083-307-5600

- Email: vrech@kris.co.za