ACI shows promising growth across multiple indicators

Johannesburg, 5 December 2024 – Afrimat, the JSE-listed mid-tier mining and materials company providing construction materials, industrial minerals, bulk commodities, and future materials and metals has released the findings of its Afrimat Construction Index (ACI) for the third quarter of 2024. The ACI is a composite index of the level of activity within the building and construction sectors and is compiled by economist Dr Roelof Botha on behalf of Afrimat.

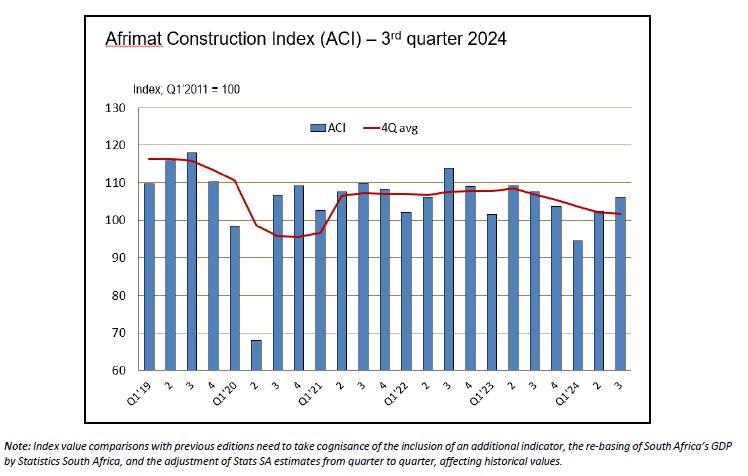

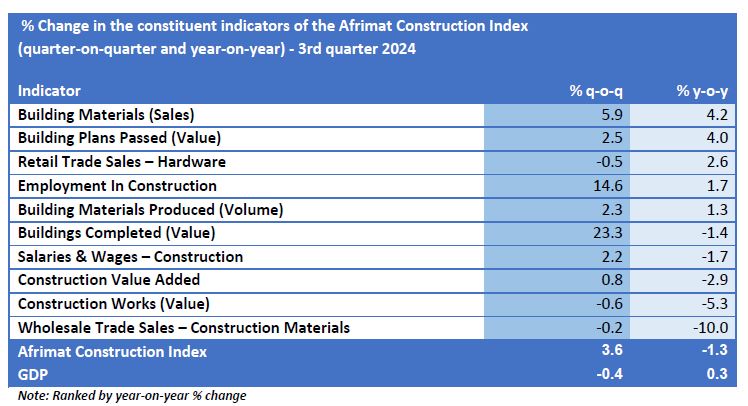

“Similar to the reading last quarter, seven of the ten constituent indicators comprising the index are in positive territory, but of particular note this time around is the significant improvement in three indicators this quarter,” said Dr Botha.

These include “Buildings Completed”, particularly in the metros and larger municipalities, which was up by 23.3%, “Employment in construction” up by 14.6%, and “Sales Values of Building Material” up by 5.9%.

Other indicators that recorded meaningful improvements on a quarter-on-quarter basis were the value of “Building Plans Passed”, the volume of “Building Materials Produced” and the remuneration of construction sector employees, as indicated in “Salaries & Wages – Construction”.

“However, compared to the third quarter of last year, i.e. 2023, it is clear that the general lethargy in construction sector activity has persisted, with the ACI declining by 1.3% overall since then,” commented Dr Botha.

He added that little doubt exists over the depressing effect that high interest rates continue to exert on the construction industry, most notably exceptionally high debt-servicing ratios and a persistent decline in the real value of credit extension, as also confirmed by several other key economic indicators. During the third quarter of 2024, South Africa’s real GDP only managed a 0.3% increase year-on-year and declined from the level recorded in the second quarter, whilst the latest Absa/BER purchasing managers’ index (PMI) for manufacturing has again slipped to below the neutral level of 50.

The residential property market also continues to lag, with the BetterBond Index of home loan applications having declined by 13% since the Monetary Policy Committee (MPC) of the South African Reserve Bank started to implement a restrictive monetary policy stance, resulting in the highest commercial lending rates in 14 years, despite the absence of demand inflation in the economy.

“On a positive note, the rate hiking cycle is reversing somewhat, although the two declines of 25 basis points each since September are inadequate to assist the country’s quest for higher economic growth and employment creation. Hopefully, the MPC will lower rates further early in 2025, which is one of the most important triggers for reviving construction sector activity.”

Dr Botha said that another positive development has been the inaugural national summit for crime-free construction sites, held in Durban on 19 November. A spokesperson for the Master Builders Association, representing more than 4,000 construction companies, described it as “groundbreaking.”

“The declaration signed at the summit outlines a framework of interventions to combat criminality at construction sites, including the strengthening of industry legislation, developing structured policies, enhancing data systems, and establishing rapid-response mechanisms to expedite arrests and prosecutions for extortion.”

Afrimat’s CEO, Andries van Heerden, indicated that he was encouraged by the data in this ACI release. “We previously indicated that across the construction landscape, the Construction Materials segment enjoyed slightly elevated volumes from road, rail, and dam projects and we continue to experience demand for our aggregates.”

He added that the integration of the Lafarge businesses is proceeding extremely well and is being undertaken meticulously despite being one of the fastest the Group has done. “There are only a few more steps to reach full integration, and we are pleased to announce that the cement processing plants are now providing Afrimat branded product, with the first 32,5 N and 42,5 N bags of cement introduced into the market.”

Van Heerden confirmed that while the Group is not yet seeing a massive uptick in the infrastructure development and maintenance side of the economy, slowly but surely small pockets of demand are opening up. He went on to reiterate that South Africa needs improvement in the ports, rail logistics, and a generally higher economic growth rate, to stimulate the economy further and to help provide much-needed jobs.

-Ends-

Issued for: Afrimat Limited

- Contact: Andries van Heerden, Chief Executive Officer (CEO)

- Tel: 021-917-8853

- Email: andries@afrimat.co.za

- Website: www.afrimat.co.za

- Issued by: Keyter Rech Investor Solutions

- Contact: Vanessa Rech

- Tel: 083-307-5600

- Email: vrech@kris.co.za