Diversification is the key to growth for Afrimat. This is underpinned by the entrepreneurial flair that is embedded in the Group’s DNA. These factors come together in a harmonised way that ensures all obstacles are carefully navigated and overcome to drive superior returns for shareholders.

Afrimat is covered by the following sell-side analysts, whom you are free to contact:

Chronux Research

rowan.goeller@chronux.co.za

SBG Securities

tim.clark@sbgsecurities.com

Smalltalk Daily

vrech@kris.co.za

Primaresearch

If you wish to enquire about the research, please follow this link.

Vunani Securities

kdutoit@vunanisecurities.co.za

Afrimat is known for being an extraordinarily successful business due to its strategic focus, thorough planning, meticulous execution, and consistent monitoring and measurement of the initiatives it implements.

Afrimat is a leading, black-empowered open-pit mining group that supplies construction materials and industrial minerals to a range of businesses and industries across southern Africa. The Group also supplies bulk commodities to both local and international markets and offers a comprehensive suite of contract mining services to the mining, construction, and quarry industries. More recently, Afrimat started supplying phosphates to the agriculture sector.

The Group is listed in the Basic Materials: General Mining sector.

The business is built on the principle of an entrepreneurial culture that seeks to ensure sustainability and profitability by positioning itself as a multi-commodity, mid-tier miner that also produces and supplies construction materials and high-quality industrial minerals.

Afrimat is known for being an extraordinarily successful business due to its strategic focus, thorough planning, meticulous execution, and consistent monitoring and measurement of the initiatives it implements. This is done within an ethical framework and a people-centric culture that breeds success and rewards performance.

This ethical viewpoint, based on the belief that excellence can be achieved without compromising integrity, further ensures a caring organisation that deems environmental, social and governance (ESG) factors to be critical to its operations, and as such Afrimat engages regularly and transparently with all its stakeholders, including the communities within which it operates.

Afrimat offers several strategic advantages to shareholders.

After listing in 2006, the Group embarked on a diversification strategy to ensure the long-term success and sustainability of the business. This strategy has effectively protected Afrimat against lower economic growth rates in South Africa, with further diversification into bulk commodities helping to position the Group as a Rand hedge, able to earn foreign currency.

An exacting focus on capital allocation and cash conversion has further ensured the Group’s ability to be a consistent dividend payer, with a dividend cover of 2,75 times in place.

Consistent diversification has ensured smooth growth for more than a decade supported by a good blend of local and internationally priced commodities. This in turn provides exposure to different currencies and economic cycles, all of which are managed through similar operational skills that Afrimat has nurtured for decades. After taking control of a new business or opportunity, Afrimat leadership, operational excellence, and operational efficiency are entrenched.

This steadfast diversification stance has ensured the delivery of:

In FY2024, Afrimat achieved impressive growth across key metrics:

Afrimat focuses on cash generation, preservation and capital allocation to ensure a high return profile in projects invested in.

Afrimat invests in projects that yield fruitful returns, further strengthening product diversity and competitive advantage. The return on net operating assets equalled 25% in FY2024. Most recently, Afrimat acquired 100% of the shareholding in Lafarge South Africa, enhancing its strategic position.

When assessing Afrimat as a potential investment opportunity, it is important to note the Group’s key strengths, include:

Cash generation | free cash flow focus

Moats (geographic locations, unique metallurgy & structural cost advantage)

Scalability reduces cyclicality (protects against commodity price fluctuations)

Track record of excellent capital allocation

Exceptionally experienced executive and operational management

Healthy company culture

For career opportunities, please visit our careers portal.

For general enquiries: info@afrimat.co.za.

Please feel free to contact us should you need assistance or if you have any questions.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

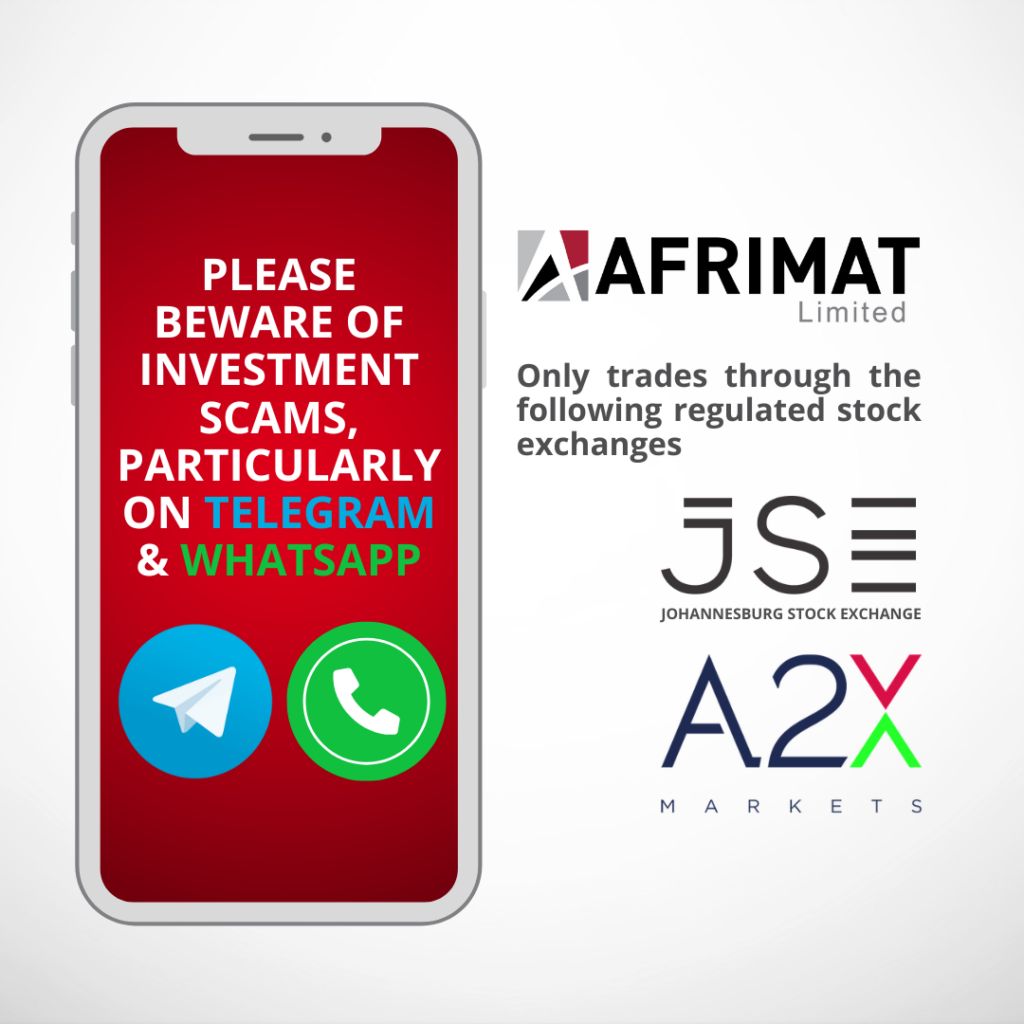

Afrimat has noted an increase in fraudulent Telegram and WhatsApp accounts, utilising Afrimat’s Corporate Identity and/or the names and photos of senior Afrimat management, offering services ranging from investment brokering to cryptocurrency trading.

Afrimat has never, and does not intend to in future, offer any financial, investment or related services through any platform.

Afrimat only trades through the regulated stock exchange of the JSE and A2X.

Any other investment scheme or financial service on any platform other than these regulated stock exchanges, are false.

Please direct any scams to our Whistle-Blowing hotline:

Afrimat: Head of Communications

Tanya.pretorius@afrimat.co.za

Keyter Rech Investor Solutions

Vrech@kris.co.za